Portuguese Primeira Liga 2025-2026: Complete Wagering Analysis

Predictions for Portuguese Liga Portugal football 2025-26

The Portuguese Primeira Liga approaches the 2025-26 season with authentic title race drama. Current market evaluations show genuine competitive equilibrium between Lisbon powerhouses, creating ideal conditions for compelling championship contests and valuable betting opportunities across various markets.

🎁 100% first deposit bonus up to 400 USD

- Site: 1xbet.com

- License: Curaçao

- Customer service:

- Promo: -

- Minimum deposit: 1$

- Minimum withdrawal: 1$

- iOS:

- Android:

🎁 300 USD +250 FS for the first deposit

- Site: mostbet.com

- License: Curaçao

- Customer service:

- Promo: -

- Minimum deposit: 1$

- Minimum withdrawal: 1$

- iOS:

- Android:

⚽ 100% bonus up to 122 EUR

🎰 100% bonus up to 300 EUR

- Site: 22bet.com

- License: Curaçao

- Customer service:

- Promo: -

- Minimum deposit: 1€

- Minimum withdrawal: 1€

- iOS:

- Android:

🎁 +500% deposit bonus

- Site: 1win.com

- License: Curaçao

- Customer service:

- Promo: -

- Minimum deposit: 1$

- Minimum withdrawal: 1$

- iOS:

- Android:

Title Contender Assessment: Portugal’s Football Hierarchy

The Portuguese championship structure maintains national football’s established order, controlled by the iconic “Big Three,” while displaying remarkable parity within the elite circle.

Portuguese Primeira Liga 2025-2026

Sporting Clube de Portugal (2.1 odds) leads through their approach of consistent development and tactical continuity. The Lisbon Lions have built a stable system that functions independently of individual stars, relying instead on team cohesion and strategic discipline.

Sporting’s advantage derives from their exceptional capacity to blend academy product development with intelligent transfer market activity. This combined method ensures both financial health and competitive strength, forming a reliable base for sustained achievement.

Benfica (2.35 odds) follows closely, making the title chase highly competitive. The Eagles focus on squad renewal through calculated investments in emerging talents aimed at establishing prolonged control.

Benfica’s strategy employs one of Europe’s top youth development centers alongside targeted international-quality player recruitment. This approach may deliver quick returns if young prospects successfully adjust to top-level requirements.

Porto (5.5 odds) sits in a distinctly different odds bracket, though Portuguese football chronicles contain numerous instances of the Dragons producing remarkable performances during crucial moments. The northern club traditionally thrives in mental battles against Lisbon rivals.

Porto’s approach emphasizes tactical organization and complete individual dedication. Despite having fewer resources than competitors, they compensate through team unity and creative tactical arrangements.

Braga (50 odds) represents Portugal’s fourth power, although the elite separation remains substantial. The Minho club occasionally delivers inspired displays but presents no systematic challenge to Big Three dominance.

Other championship participants receive 100+ odds, indicating their tournament function – relegation struggles and sporadic upset attempts against more established opponents.

| Club | 1xBet/22Bet/MelBet |

|---|---|

| Sporting Clube de Portugal | 2.1 |

| Benfica | 2.35 |

| Porto | 5.5 |

| SC Braga | 50 |

| Estoril | 100 |

| Aves | 100 |

| Arouca | 100 |

| Moreirense | 100 |

| Vitoria Guimaraes | 100 |

| Nacional da Madeira | 100 |

| Gil Vicente | 100 |

| Rio Ave | 100 |

| Tondela | 100 |

| Santa Clara | 100 |

| Famalicao | 100 |

| Estrela da Amadora | 100 |

| Casa Pia | 100 |

| Alverca | 100 |

Title Contender Assessment Portugal’s Football Hierarchy

Champions League Access: Elite Competition Race

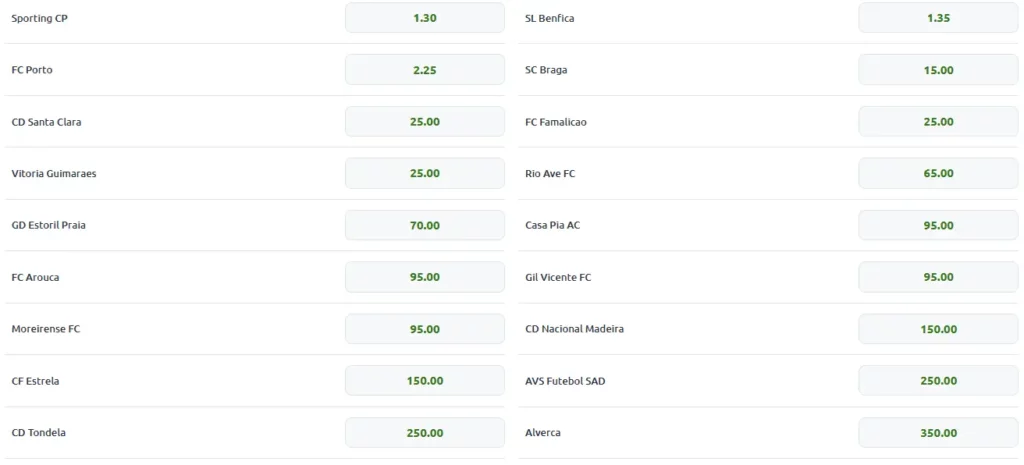

The Portuguese championship’s top-two market creates remarkable circumstances – authentic three-way battle for two Champions League spots. This situation generates exceptional opportunities for advanced long-term betting approaches.

Sporting (1.30 odds) holds slight advantage through recent seasons’ reliable performances. The Lions show consistency vital for secured European tournament involvement.

Benfica (1.35 odds) receives nearly identical top-two consideration, reflecting squad talent and youth development potential. The Eagles maintain adequate depth for multiple competition engagement.

Primary excitement focuses on the third top-two contender. Porto (2.25 odds) has realistic potential for displacing one Lisbon giant, making every direct meeting between these clubs crucial for final standings.

Notably, Braga (15.00 odds) carries pricing 6-7 times higher than Porto, showing qualitative distinction between the Big Three and other championship teams. The Arsenalistas aim for third position at maximum.

Second-tier clubs – Santa Clara, Vitoria Guimaraes, and Famalicao (all 25.00 odds) – theoretically might achieve breakthrough campaigns, yet their top-two possibilities remain entirely theoretical.

| Club | Odds |

|---|---|

| Sporting CP | 1.30 |

| SL Benfica | 1.35 |

| FC Porto | 2.25 |

| SC Braga | 15.00 |

| CD Santa Clara | 25.00 |

| Vitoria Guimaraes | 25.00 |

| FC Famalicao | 25.00 |

| Rio Ave FC | 65.00 |

| CD Estoril Praia | 70.00 |

| Casa Pia AC | 95.00 |

| FC Arouca | 95.00 |

| Gil Vicente FC | 95.00 |

| Moreirense FC | 95.00 |

| CD Nacional Madeira | 150.00 |

| CF Estrela | 150.00 |

| CD Tondela | 250.00 |

| AVS Futebol SAD | 250.00 |

| Alverca | 350.00 |

Champions League Access Elite Competition Race

Domestic Cup Competition: Knockout Tournament Drama

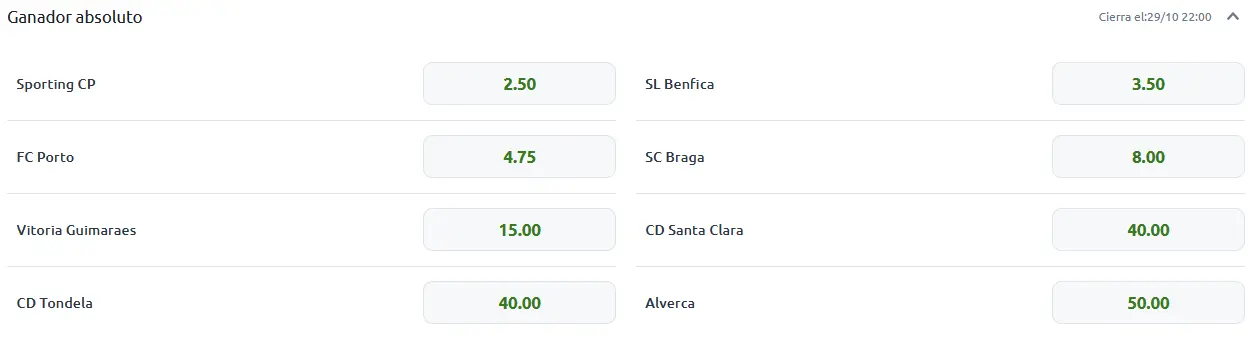

Sporting (2.50 odds) appears as cup competition favorite, logically reflecting their championship position and squad resources. The Lions treat the domestic cup seriously as an additional trophy opportunity.

Benfica (3.50 odds) stands as Sporting’s main cup challenge. The Eagles maintain strong tournament history, often using cup matches for young talent introduction to senior level competition.

Porto (4.75 odds) may provide better value among favorites. Cup formats highlight mental aspects, where Dragons historically excel in critical matches against higher-ranked opponents.

Braga (8.00 odds) consistently reaches tournament’s advanced rounds, capable of challenging any giant in single-game situations. The Minho club’s underdog approach often proves beneficial.

| Club | Odds |

|---|---|

| Sporting CP | 2.50 |

| SL Benfica | 3.50 |

| FC Porto | 4.75 |

| SC Braga | 8.00 |

| Vitoria Guimaraes | 15.00 |

| CD Santa Clara | 40.00 |

| CD Tondela | 40.00 |

| Alverca | 50.00 |

Domestic Cup Competition Knockout Tournament Drama

Summer Transfer Activity: Squad Development Strategies

The 2025 Portuguese football transfer window demonstrated calculated planning from all Big Three representatives. Each institution chose different development directions, producing distinct squad-building approach combinations.

Sporting: Global Talent Acquisition Excellence

Sporting implemented an ambitious worldwide recruitment initiative, securing talents from various footballing backgrounds. The Lisbon Lions proved their ability to compete in international transfer markets.

Luis Suárez emerged as the key midfield acquisition for tactical balance. The seasoned midfielder brings international-quality performance and leadership characteristics necessary for title objectives.

Georgios Vagiannidis for €12 million represents calculated defensive investment, contributing Greek international experience and adaptability across multiple roles. His technical skills and tactical awareness significantly enhance Sporting’s defensive possibilities.

Georgi Kochorashvili reinforced defensive areas with European experience, while Rui Silva improved attacking build-up flexibility. Alisson Santos embodies South American creative midfield culture.

Promising signings João Virgínia and Diogo Trivaldos show long-term vision and youth development trust.

Major departures include Viktor Gyökeres, Dário Essugo, Marcus Edwards, Franco Israel, and Vladan Kovačević. Gyökeres’ departure proves especially damaging – the Swedish striker functioned as attacking structure cornerstone.

Financial equilibrium remained positive through calculated sales, allowing quality reinforcement reinvestment without jeopardizing financial health.

Luis Suárez Sporting

Benfica: Youth-Focused Reconstruction

Benfica chose comprehensive squad renewal approach, investing in players expected to shape club identity throughout the coming decade.

Franjo Ivanović for €22.80 million leads acquisitions as a flexible attacking talent contributing Croatian technical quality and European experience. His speed, creativity, and positional adaptability offer tactical variety across forward areas.

Richard Rios became vital creative midfield acquisition, bringing Colombian technique and contemporary positional play understanding. Amar Dedić strengthened right defensive areas with Balkan dependability.

Samuel Dahl and Rafa Obrador represent foundational squad investments – defensive solidity forming any serious project’s foundation.

Notable departures include Ángel Di María – the Argentine maestro represented creativity and experience. Álvaro Carreras, Arthur Cabral, Casper Tengstedt, João Mário, Sevalino Menze, and Martim Neto also left.

Renewal approach may produce long-term benefits, though immediate adaptation risks appear in bookmaker evaluations.

Porto: Complete Squad Modernization

Porto conducted extensive squad updating, combining seasoned professional signings with promising player investments.

Victor Froholdt for €20 million contributes Scandinavian work ethic to central midfield, while Gabri Veiga adds Spanish technical quality to attacking formations.

Alberto Costa (€15 million) and Nehuén Pérez (€13.30 million) substantially reinforce defensive structure with international experience and proven ability. These signings address defensive depth issues while adding tactical flexibility.

Borja Sainz and Jan Bedranek provide quality midfield alternatives, while Dominik Pryč and João Costa represent future development investments.

Significant losses include Francisco Conceição, Otávio, João Mário, Gonçalo Borges, Fran Navarro, and Iván Marcano. Conceição and Otávio departures particularly affect attacking capability.

Multiple newcomer integration needs alongside experienced leader exits explain Porto’s relatively higher odds.

Nehuén Pérez Porto

Braga: Focused Squad Improvement

Braga worked within financial limitations, focusing on targeted reinforcements without dramatic changes.

Mario Dorgeles for €11 million represents meaningful investment in creative midfield talent, contributing technical ability and scoring threat from advanced positions. His adaptability and work ethic align perfectly with Braga’s tactical needs.

Pau Víctor added Spanish midfield technique, while other additions strengthened various areas with international experience. Leonardo Lelo and Djibril Soumaré provided squad depth without major philosophical changes.

Minimal departures – Roberto Fernández, Mateus, and José Mendes – allowed project continuity while incorporating quality additions.

Transfer Impact on Competition Balance

Summer activities confirmed and strengthened existing order:

- Sporting reinforced leadership through balanced development approach

- Benfica invested in future achievement while accepting short-term adaptation challenges

- Porto modernized comprehensively but requires integration period for new signings

- Braga maintained stability while elite gap slightly increased

These developments fully align with bookmaker assessments and establish groundwork for Portuguese football’s most engaging seasons

Zephyr Blackwood

Zephyr Blackwood